Finding the Right Buyer for Your Business: M&A Acquirer Profiles

Key Takeaways:

Not all buyers are created equal - understanding the differences between strategic and financial buyers is essential to finding the right fit and maximizing the value of your sale.

The structure and strategy behind each M&A deal shapes the long-term outcome for your business, stakeholders, and legacy – do your research and choose wisely.

Hiring an experienced merger & acquisition advisor is one of the smartest moves a seller can make. Expert guidance helps you navigate complex decisions, vet the right buyers, and ultimately close a sale transaction that aligns with your goals.

The Types of M&A Buyers

When selling your business, a critical decision is to select the buyer whose goals, capabilities, and economic incentives align with your long-term vision for the future of your company.

Closing the deal is only part of the equation. Tremendous value lies in selecting an acquirer who can preserve what you've built while advancing your strategic objectives, especially for business owners and/or key employees that will continue to work for the acquiring company.

Choosing the wrong buyer can disrupt operations, negatively impact stakeholders, and jeopardize your legacy. That’s why thoughtful planning and a deep understanding of the sell-side M&A process are helpful for positioning your company for the right opportunity.

Before making any decision, ensure you thoroughly understand the different buyer types and their unique motivations.

Potential Buyer Profiles

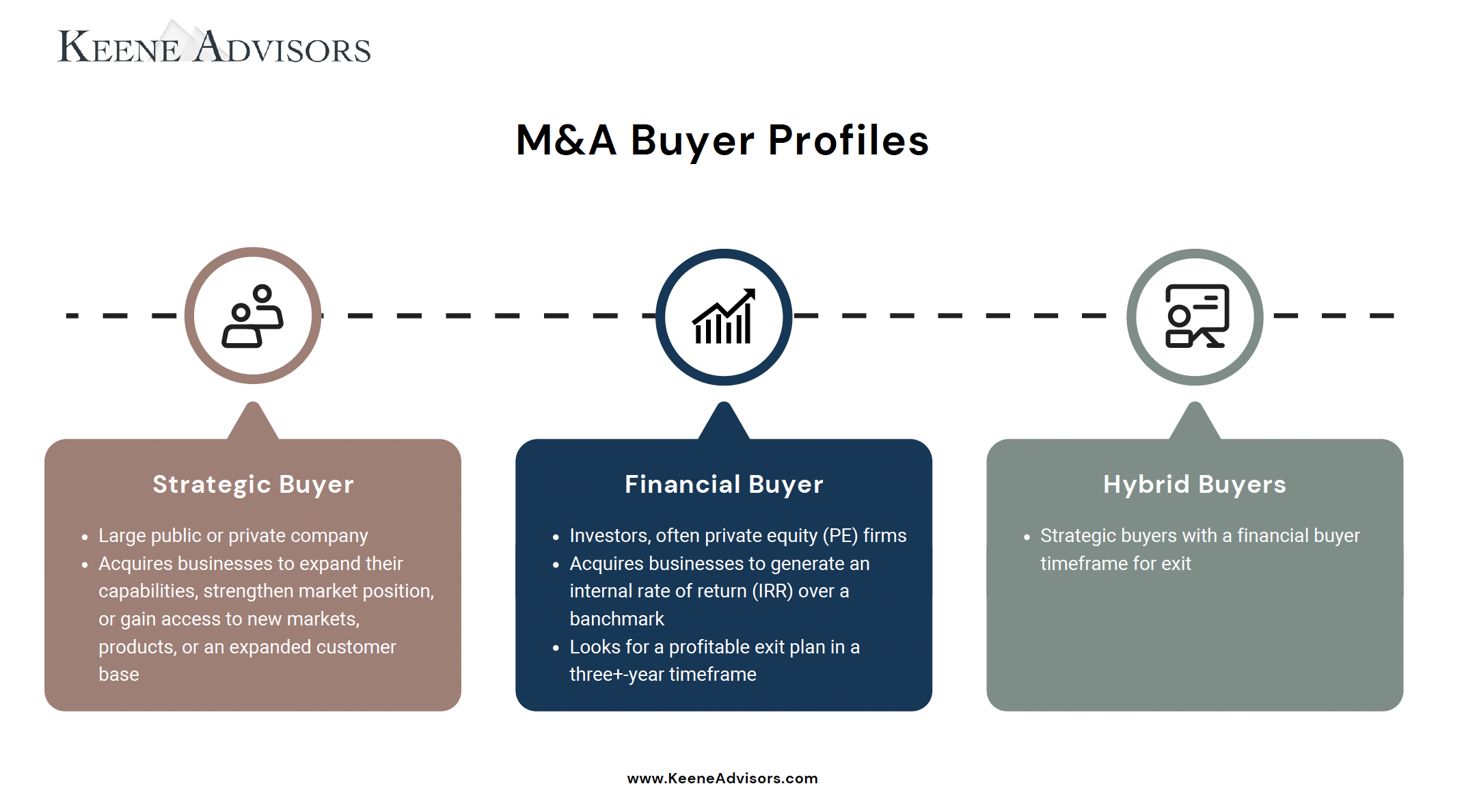

Acquirers typically fall into one of three main categories: strategic buyers, financial buyers, or hybrid buyers (strategic buyers owned by financial buyers). Each group has distinct motivations and acquisition strategies that they pursue. Understanding these differences will help business owners and executive teams navigate the sale process effectively. There are material differences between the types of buyers:

Strategic Buyer: Typically larger public or private companies that acquire businesses to expand their capabilities, strengthen their market position, or gain access to new markets, products, or an expanded customer base.

Financial Buyer: Typically, investors such as private equity (PE) firms that have two main acquisition goals: generating an internal rate of return (IRR) over a benchmark rate and developing and executing a profitable exit plan within a three+-year timeframe.

Hybrid Buyer (Strategic Buyer, backed by a Financial Buyer): Typically, strategic buyers that approach an acquisition like a strategic buyer, looking to expand capabilities, strengthen market position, increase scale, eliminate costs, etc. but with a financial buyer time frame for exit.

Strategic Buyers

Strategic buyers are generally companies operating in your industry or adjacent industries that seek growth via acquisitions to:

Expand their market position

Defend their market position from competitors

Enter new markets or geographies

Capitalize on revenue or cost synergies

Achieve greater scale and multiple expansion

Among others

Valuation Premiums

By combining their existing operations with the operations of the target, strategic buyers are often able to drive faster growth and improved margins for the combined enterprise. As a result, a strategic buyer may be able to justify a higher purchase price for a target business than a financial buyer. The greater the revenue and cost synergies for the strategic buyer, the greater the ability of the strategic buyer to justify a higher valuation.

Acquisition Consideration

Strategic buyers may offer cash, stock, seller notes, earnouts or other economic value as consideration for the acquisition (employment contracts, etc.). For sellers, alternative forms of consideration like stock, seller notes or earn-outs can be attractive as part of an aggregate proposal. Stock provides upside opportunities so the seller can benefit from some of the benefits of the combination, seller notes and earn-outs can be used to bridge bid-ask differences between the buyer and seller and provide an attractive yield or upside based on performance. However, these non-cash forms of consideration come with risks that could materially impact the ultimate net proceeds a seller receives from a transaction. It is critical to have expert merger & acquisition advisors and experienced legal counsel to evaluate these options and opine on the risks and opportunities.

Financial Buyers

Financial buyers primarily acquire companies as an investment opportunity to generate financial returns. These buyers typically focus on specific financial and operational metrics and often employ strategies like leveraged buyouts (LBOs), where a significant portion of the purchase price is financed through debt, to enhance potential returns.

Unlike strategic buyers, who seek synergies and long-term strategic benefits, financial buyers rely on improving the performance of the target business over defined investment horizons, usually aiming to exit the investment within five to eight years, reducing debt, and improving valuation multiples to derive their returns. Given their high equity return expectations, the amount of debt and the cost of debt are critical drivers of the cost of capital and return potential. In markets where the availability of leverage is low, or interest rates are high, financial buyers may be unable to value businesses as high as strategic buyers.

Acquisition Consideration and Equity Rollovers

Non-cash consideration is common in financial M&A deals, including stock (rollover equity), seller notes, earnouts, and other sources of economic value like employment contracts. Rollover equity provides sellers with a “second bite at the apple”, participating in any future growth and value creation, and it ensures that the sellers and buyers maintain some alignment of interest going forward. Rollover equity is particularly important for founders and executive team members that are going to have a role in driving the future performance of the target business.

Rollover Equity Highlights:

Enables the seller to retain an equity stake in the business, benefiting from future upside while still achieving partial liquidity from a sale.

Aligns the interests of both the buyer and seller, reducing risk and easing the financial obligation necessary for the buyer to close the transaction.

Rollovers can be structured in various ways, depending on the specifics of the deal and market conditions, and are common in private equity-backed financial acquisitions.

Strategic vs Financial Buyer: Key Differences

Understanding the distinctions between strategic and financial buyers is crucial in the M&A sale process:

Strategic Buyers:

Motivation: Seek acquisitions that offer business or economic synergies, such as expanding product lines, entering new markets, or eliminating competition.

Integration: Plan to merge the acquired company into their existing operations for long-term strategic benefits.

Valuation: Might be willing to pay a premium over financial buyers due to the anticipated synergies and strategic advantages of the acquisition.

Financial Buyers:

Motivation: Focus on investments that provide an internal rate of return (IRR) above an internal benchmark, a high multiple on invested capital (MOIC) and an exit within five to eight years

Integration: Typically maintain the acquired company as a standalone entity, aiming to enhance its financial performance individually or as part of a portfolio of companies in the same industry. Additionally, may pursue M&A / roll-up strategies to merge/ consolidate additional companies.

Valuation: Evaluate based on the company's earnings capabilities and is closely related to valuation multiples of similar companies. Acquisition financing often employs leverage to enhance future returns.

These differences influence the acquisition approach, valuation, and post-acquisition strategy.

Common M&A Strategies and What They Mean for the Sell-Side of the M&A Process

Understanding how your company fits into the overall M&A strategy of the buyer, whether strategic or financial, will help sellers clarify whether or not acquirer’s goal aligns with your vision for your company's future.

Below is a brief overview of common M&A strategies and the end goal for the acquiring company:

Horizontal: A company acquires a competitor to increase market share, reduce competition, or achieve economies of scale in one or more aspects of the business. Acquirers in a horizontal acquisition may be able to pay a premium price because they will capture significant cost savings (synergies) through headcount reductions, elimination of redundant real estate or technology, among others. Depending on the relative size / brand value of the target and acquirer, horizontal acquisitions may involve collapsing the brands, preserving separate brands, or creating a new combined brand.

Vertical: A company acquires a business that is part of their current supply chain in order to improve operations efficiency, reduce costs, or gain access to an extension of the supply chain. The target business can be upstream or downstream from the acquirer. Acquirers in a vertical acquisition may be able to pay a premium price if there are significant cost savings or competitive advantages from integrating the supply chain, however integrating the supply chain can also create conflicts with competitors of the acquiring company that could be current or prospective customers of the target. Cost savings efforts and customer conflicts can both be disruptive to the target business.

Market-Extension: A company acquires a business to extend geographical reach or enter new markets. Market-extension acquirers are less likely to benefit from significant cost savings / synergies compared to horizontal or vertical acquirers. For sellers, this means buyers are less likely to pay a significant premium but there is likely to be less disruption for the target business.

Product-Extension: A company acquires a business with complementary products to expand their cross-sell to new and existing customers or enter adjacent markets. Buyers may be willing to pay a premium if this strategy is likely to accelerate growth. The disruption for the target business is often minimal outside of corporate and G&A areas.

Roll-Up: A company acquires many smaller competitors to consolidate a fragmented market. Often roll-ups involve acquiring smaller companies at lower multiples, leveraging shared infrastructure / corporate overhead and best practices / technology to drive increased revenue and improve margins. Through increased scale, higher revenue growth and improved margins, roll-up acquirers seek to accelerate value creation through multiple expansion. Disruption can be significant in roll-up transactions, including the elimination of the target brand / name.

Bolt-On: A company acquires complementary smaller businesses to enhance existing capabilities or products. Bolt-on acquirers can be pursuing other M&A strategies, for example horizontal or market-extension. What distinguishes them is that bolt-on acquisitions tend to be smaller, less transformational transactions for the acquirer and often include the elimination of the target brand / name.

Defensive: A company acquires a business to prevent competitors from gaining a strategic advantage or to block new entrants to a key market. Acquirers may be willing to pay a premium price for a defensive acquisition. These acquisitions are less likely than other strategies to disrupt the target business.

Evaluating Potential Buyers

Here are proactive steps to help you identify the best potential buyers for your business:

Ensure Your House Is in Order Before Approaching Buyers

Completing your background work before meeting with potential buyers is crucial to ensure a smooth and effective process.

Start by clearly defining your goals and motivations for selling, as this will help you align your M&A strategy with the right buyer type.

Assemble a strong sell-side M&A team, including merger & acquisition advisors, attorneys, and accountants, to support you throughout the process.

Finally, determine which buyer type - strategic or financial - best aligns with your objectives, as this will impact how you approach the sale process, the structure of the deal, and the long-term outcome.

Whether aiming for a full exit or a long-term partnership, understanding what you want from the deal will guide your decision-making and help you quickly eliminate potential buyers not aligned with your goals and objectives.

How to Identify the Right Acquirer Company

Pinpointing the best acquirer company means vetting for both capability and compatibility. Evaluating their readiness, financial position, reputation and experience can help mitigate future risks and create a smoother transaction.

Consider working with a merger and acquisition advisor to compile a wide-reaching buyer list that covers key considerations you’re looking for as a seller such as industry strength, financial capability, strategic fit, track record, reputation, and potential networking connections. This step of the process is vital for identifying the right potential buyers who align with the company’s goals and motivations. Doing this work upfront improves the seller’s chances of achieving a successful, profitable transaction.

Warning Signs to Watch for During the Sell-Side M&A Process

Even with a rigorous background check, strategic analysis and due diligence, there are times when warning signs appear during the M&A process. Some warning signs to look out for include:

Unreliable capital source: Lack of guaranteed funding can jeopardize the deal’s closing.

Poor communication: Delayed responses, unresponsiveness, or disorganized communication can signify that the buyer isn’t sure about moving forward.

No clear post-acquisition plan: Lack of clarity may equal a misalignment of long-term vision or inability to execute on goals after the transaction closes.

Work With a Merger & Acquisition Advisor to Identify, Evaluate, and Vet Potential Buyers for Your Business

A merger & acquisition advisor can help you define and prioritize your objectives for pursuing a sale transaction, identify the buyers that will help you achieve your objectives, and develop a sale process that maximizes your likelihood for a successful transaction. M&A advisors can be generalists or specific to your industry. Whether you choose a generalist or industry specialist, you should work with seasoned professionals that have experience maximizing net proceeds, minimizing stress, and identifying and addressing issues as they arise.

Keene Advisors is a Full-Service Investment Banking Advisory firm. Our team has advised on over $40 billion in successful mergers and acquisitions, capital raising, and restructuring advisory transactions. We are dedicated to transparent communication and seamless guidance throughout every stage of the M&A process, always aiming to align short-term needs with long-term goals.

Contact us today with your inquiries and to learn more about how we can help you achieve a successful sale.

Disclaimer: This commentary is intended for general informational purposes only. Keene Advisors does not render or offer to render personalized financial, investment, tax, legal or accounting advice through this report. The information provided herein is not directed at any investor or category of investors and is provided solely as general information. No information contained herein should be regarded as a suggestion to engage in or refrain from any investment-related course of action. Keene Advisors does not provide securities related services or recommendations to retail investors. Nothing in this report should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.