For many founders and family-owned businesses, a sale, recapitalization, or other liquidity event for their company is one of the most significant decisions they will ever make.

Before hiring an investment bank to help guide your process, make sure you review these key considerations.

Liquidity events for private companies are not limited to acquisitions or IPOs. Family- and founder-led companies face unique succession and shareholder dynamics, making long-term liquidity planning essential to protect company value and preserve a founder’s legacy.

A CFO's Roadmap to Strategic Impact

The first 100 days in the CFO seat represent a decisive inflection point — the period where credibility is either firmly established or quietly undermined. Master your first 100 days as CFO to build credibility, establish control, and create long-term value.

An in depth discussion about cash flow and liquidity management for private companies. From generating a short-term 13-week cash flow model to longer-term liquidity management strategies, the Keene Advisors’ team provides practical management advice.

AI chatbots now generate financial models instantly, but founder-owned businesses need transparency, not black boxes.

But can you defend a model you didn't build? Discover why Excel templates may be a better solution and learn how to get started quickly.

The credit spread environment remains favorable for refinancing existing credit facilities and originating new corporate credit. Companies with existing credit facilities maturing in the next 12-24 months should consider refinancing in the current credit spread environment, as doing so may generate substantial savings in long-term borrowing costs.

Case Study: How Keene Advisors built a data-driven, pricing model for a client that prioritizes sustainability and mission. Our team recommended a value-based pricing strategy designed to align pricing with outcomes, streamline internal operations, and reward revenue-driving customer behaviors.

Deal structure is just as important as the headline price when selling your business. Asset sale, stock sale or merger - what you ultimately decide impacts your final net proceeds.

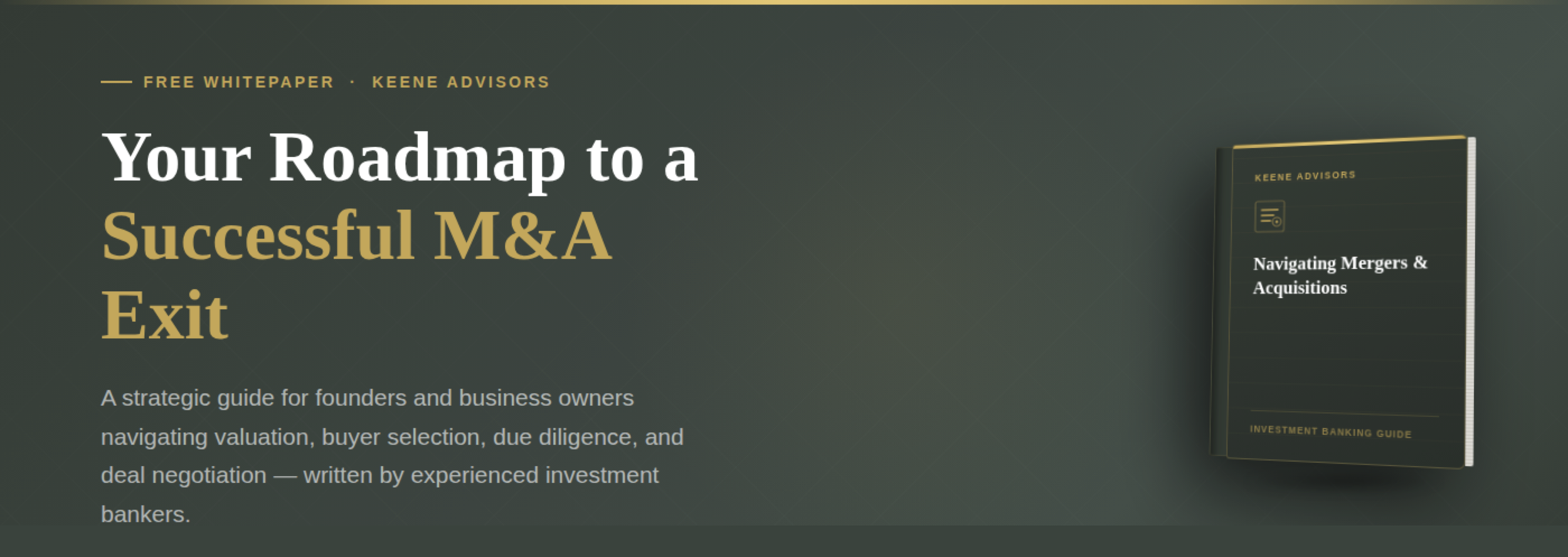

Explore Keene Advisors' detailed guidance on how business owners, CFOs, and executive team leaders can manage the Mergers and Acquisitions (M&A) process to maximize a sale of your company.

Business owners and founders - are you thinking about selling your company? The Keene Advisors team of investment bankers has compiled our top advice into a free whitepaper to provide you with for a roadmap to a successful exit. Prepare now to maximize your outcome.

Corporate credit spreads have started to widen, but they remain well below long-term averages. For CFOs, that means refinancing a credit facility may still offer strategic advantages like locking in terms, reducing interest expense, and improving liquidity. Acting now, before spreads rise further, could be a smart financial move.

The closing phase of a business sale is one of the most underestimated stages in the M&A process. Executive leadership and M&A advisors work diligently to ensure a smooth, timely close by managing key stakeholders and verifying legal and financial conditions. This helps sellers minimize liability and achieve an optimal outcome.

Choosing the correct buyer is the most critical decision when deciding to sell your business. We detail the types of M&A buyers–strategic vs financial - and how business owners can best navigate the sale process.

During periods of economic volatility, business leaders must proactively identify and manage risks that can threaten profitability, liquidity, and long-term survival. Here are 5 proven steps to identify and evaluate business risks, assess their impact and likelihood, and develop actionable strategies to ensure financial and operational resilience.

Tariffs, potential disruptions to supply chains, and the possibility of an economic recession are causing uncertainty in financial markets and Board rooms. To navigate effectively, CEOs and CFOs must ensure effective cash flow management and ample liquidity under a wide range of possible scenarios. One of the most important tools available is the 13-week cash flow model.

The right M&A deal team drives results that help business owners meet their M&A goals. Who should be on your M&A team?

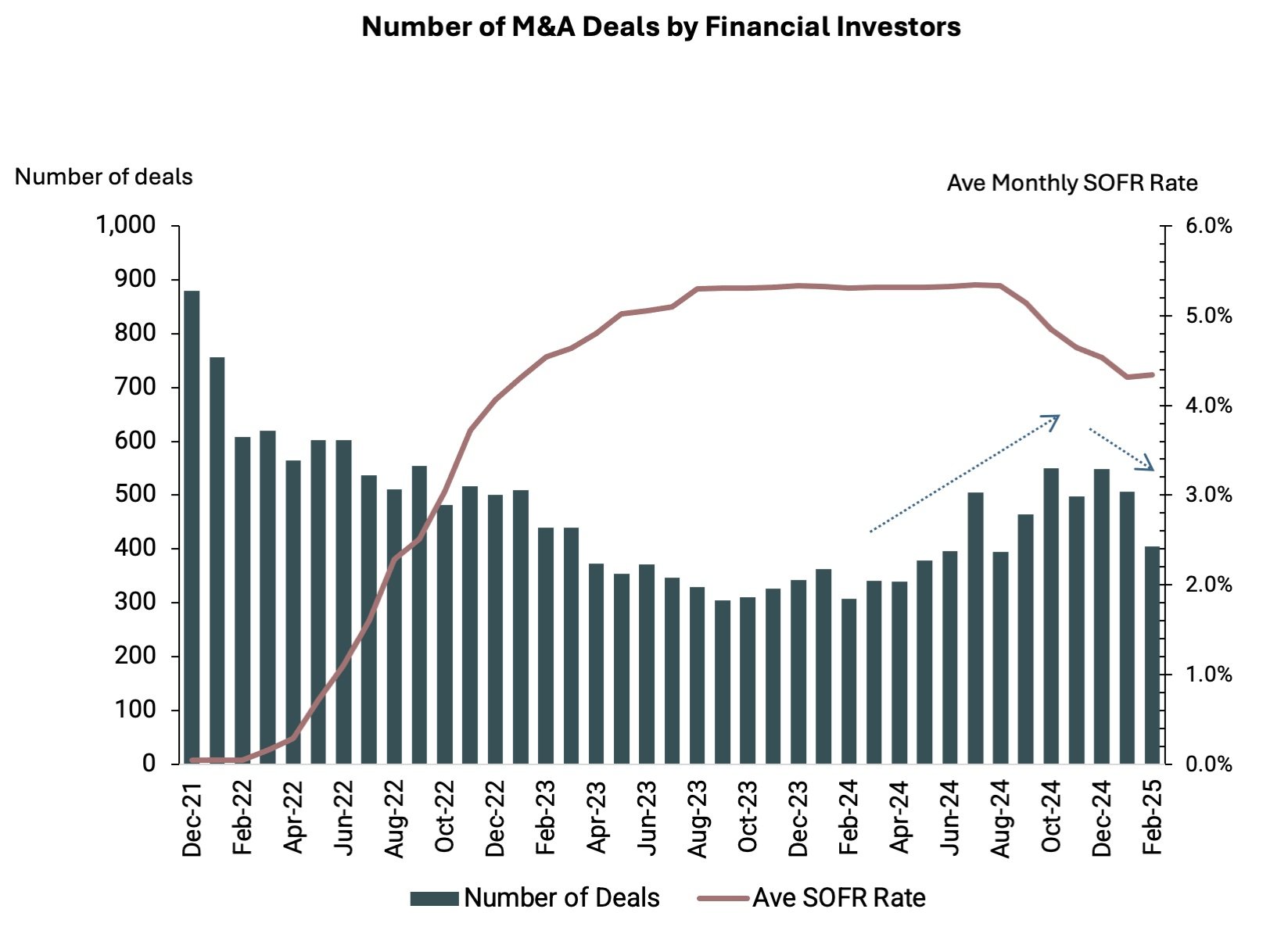

M&A activity showed signs of recovery in late 2024, but market uncertainty in early 2025 has stalled deal momentum. Despite declining borrowing costs and a record $2.6 trillion in private equity dry powder, investor hesitation has grown due to unpredictable trade and economic policies. Companies considering a sale should focus on financial preparedness and operational efficiencies to position themselves for success when dealmaking accelerates.

Selling your business is a complex process, and you must be prepared. We cover internal business reviews, key performance metrics, and adjusted EBITDA.

Understanding the motivations behind selling a business should guide a robust M&A strategy. We explain how goals, timing and market consideration impact M&A and why and when business founders should consider selling.

Hiring a generalist investment banker instead of an industry specialist investment banker might be the best decision you could make to ensure a successful business sale or capital raise. Generalist investment banking advisory firms bring broad transaction experience, offer creative deal strategies, and have access to a wide network of buyers, investors and partners.

EBITDA addbacks can maximize your company’s valuation and sale price. Discover key strategies to boost valuation and attract top buyers for your company’s M&A transaction. Learn more about EBITDA addbacks today.

Private equity funds serve as a critical source of capital for business owners seeking liquidity or looking to grow, scale, or restructure. Understanding the type of private equity fund, the size of the fund, and where a private equity fund is in its life cycle is important when considering a potential investment or acquisition proposal.

Is a Leveraged Buyout (LBO) a good strategy for business growth? Leveraged buyouts rely on debt and can enhance equity returns for investors and provide companies with additional access to capital for value creation. But they are not without risk. Disciplined execution is key to success.

Acquisition activity by private equity funds influence mergers and acquisitions (M&A) across many industries, but Q3-24 volume was down 64% from the peak. What does this mean for founder-owned and private companies who want to exit in 2025?

With corporate credit spreads at their narrowest level in 20-years, now is the time for CFOs and corporate finance teams to consider refinancing debt, including their corporate credit facility.

The rapid development and deployment of AI poses significant climate challenges, including high energy and water demands, as well as privacy risks from inadequate data regulation. Addressing these issues is critical to ensuring responsible AI growth. Can the Public Benefit Corporation (PBC) structure provide answers?

An essential tool for every CFO, learn how to build a dynamic budget model and explore the benefits of implementing the best practices of a dynamic budgeting model into your existing process. Complete primer for corporate finance executives that will help increase visibility and prioritize growth, cost savings and capital allocation opportunities.

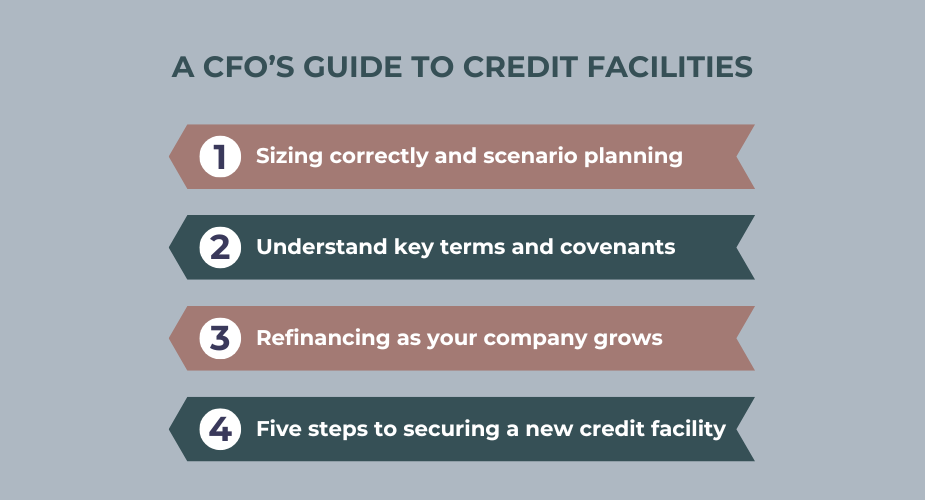

For CFOs, understanding the intricacies of credit facilities is essential for optimizing capital structure, ensuring liquidity, and managing cash flow efficiently. Download our in-depth playbook that considers best practices and guidance on how to negotiate the most competitive terms.

Organic growth or growth by acquisition? This is a strategic and tactical decision that CEOs, CFOs, and executive teams must constantly weigh. If you do choose to pursue M&A as part of a long-term growth strategy, building your M&A playbook is the key to success.

Private equity firms have a proven track record of delivering strong returns to investors and outperforming broader equity markets. But how do they do it? Check out our Top 10 Strategies for Founders, CEOs, and CFOs at private companies to drive stronger growth and value creation for their own shareholders.