Navigating the M&A Process: Key Steps to Closing the Sale of Your Business

The closing phase of a business sale is one of the most underestimated stages in the M&A process. Executive leadership and M&A advisors work diligently to ensure a smooth, timely close by managing key stakeholders and verifying legal and financial conditions. This helps sellers minimize liability and achieve an optimal outcome.

Finding the Right Buyer for Your Business: M&A Acquirer Profiles

Choosing the correct buyer is the most critical decision when deciding to sell your business. We detail the types of M&A buyers–strategic vs financial - and how business owners can best navigate the sale process.

Assembling the Right M&A Deal Team: Key Advisors That Drive Results

The right M&A deal team drives results that help business owners meet their M&A goals. Who should be on your M&A team?

Q1-25: M&A Activity Stalling Amid Market Uncertainty

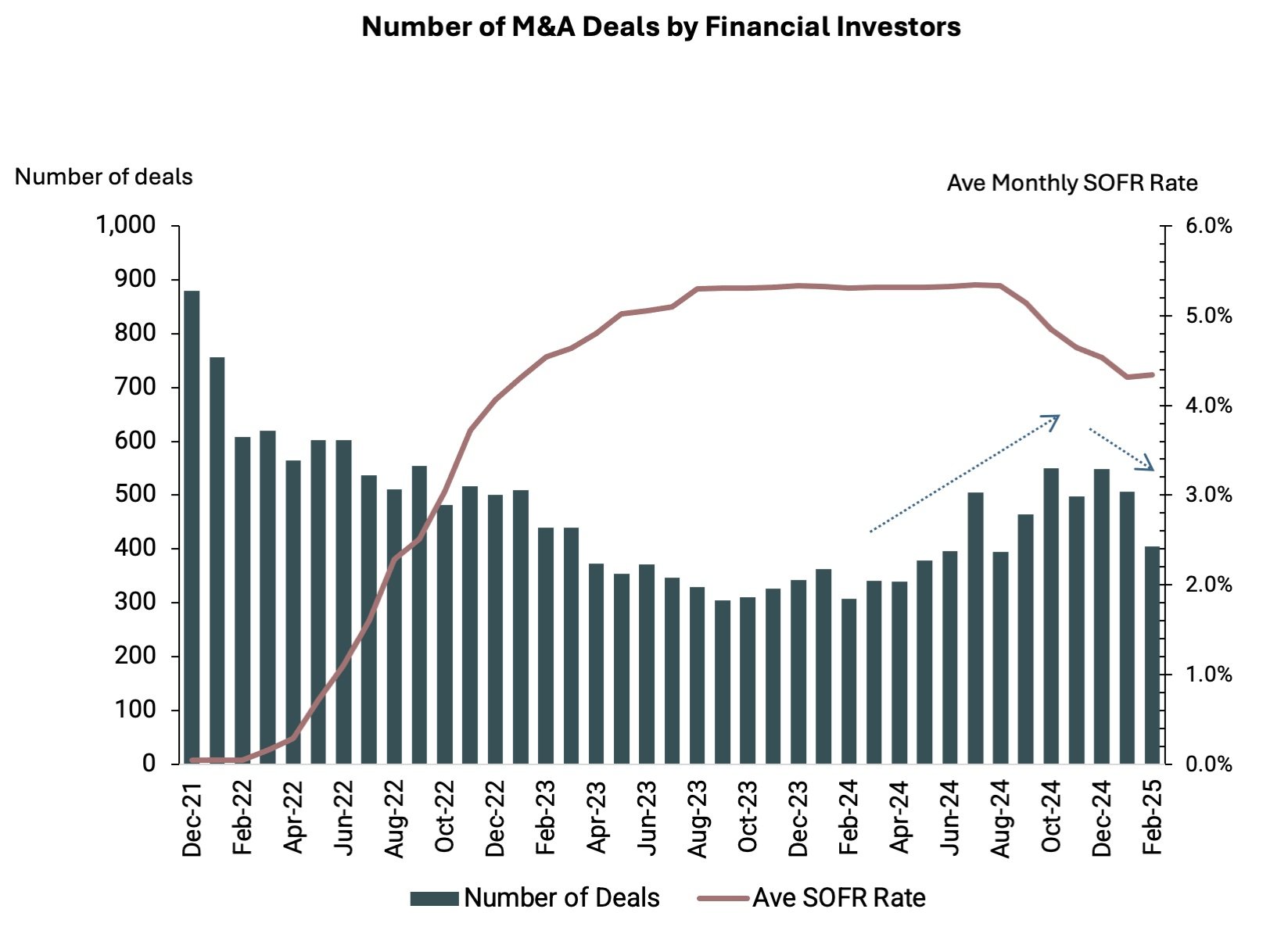

M&A activity showed signs of recovery in late 2024, but market uncertainty in early 2025 has stalled deal momentum. Despite declining borrowing costs and a record $2.6 trillion in private equity dry powder, investor hesitation has grown due to unpredictable trade and economic policies. Companies considering a sale should focus on financial preparedness and operational efficiencies to position themselves for success when dealmaking accelerates.

Preparing for the M&A Process: Laying the Foundation to Sell Your Business

Selling your business is a complex process, and you must be prepared. We cover internal business reviews, key performance metrics, and adjusted EBITDA.

Understanding the M&A Motivation: Why a Business Founder Might Pursue a Sale

Understanding the motivations behind selling a business should guide a robust M&A strategy. We explain how goals, timing and market consideration impact M&A and why and when business founders should consider selling.

Maximizing Business Value in a Sale: How EBITDA Addbacks Boost Your Valuation

Learn how EBITDA addbacks can maximize your business’s sale price. Discover key strategies to boost valuation and attract top buyers in M&A transactions.

From Raising Capital to Generating Returns: The Private Equity Fund Lifecycle

Private equity funds serve as a critical source of capital for business owners seeking liquidity or looking to grow, scale, or restructure. Understanding the type of private equity fund, the size of the fund, and where a private equity fund is in its life cycle is important when considering a potential investment or acquisition proposal.

Q3-24: M&A Activity by Financial Investors Remains Down

Acquisition activity by private equity funds influence mergers and acquisitions (M&A) across many industries, but Q3-24 volume was down 64% from the peak. What does this mean for founder-owned and private companies who want to exit in 2025?

Helping Your Acquisition Growth Strategy Deliver Long-Term Value

Organic growth or growth by acquisition? This is a strategic and tactical decision that CEOs, CFOs, and executive teams must constantly weigh. If you do choose to pursue M&A as part of a long-term growth strategy, building your M&A playbook is the key to success.