Keene Advisors Insights Series: Mergers and Acquisitions for Business Owners and CFOs

Explore Keene Advisors' detailed guidance on how business owners, CFOs, and executive team leaders can manage the Mergers and Acquisitions (M&A) process to maximize a sale of your company.

Navigating the Merger & Acquisition Journey - Free Guide for Founders and Owners

Business owners and founders - are you thinking about selling your company? The Keene Advisors team of investment bankers has compiled our top advice into a free whitepaper to provide you with for a roadmap to a successful exit. Prepare now to maximize your outcome.

Navigating the M&A Process: Key Steps to Closing the Sale of Your Business

The closing phase of a business sale is one of the most underestimated stages in the M&A process. Executive leadership and M&A advisors work diligently to ensure a smooth, timely close by managing key stakeholders and verifying legal and financial conditions. This helps sellers minimize liability and achieve an optimal outcome.

Finding the Right Buyer for Your Business: M&A Acquirer Profiles

Choosing the correct buyer is the most critical decision when deciding to sell your business. We detail the types of M&A buyers–strategic vs financial - and how business owners can best navigate the sale process.

Q1-25: M&A Activity Stalling Amid Market Uncertainty

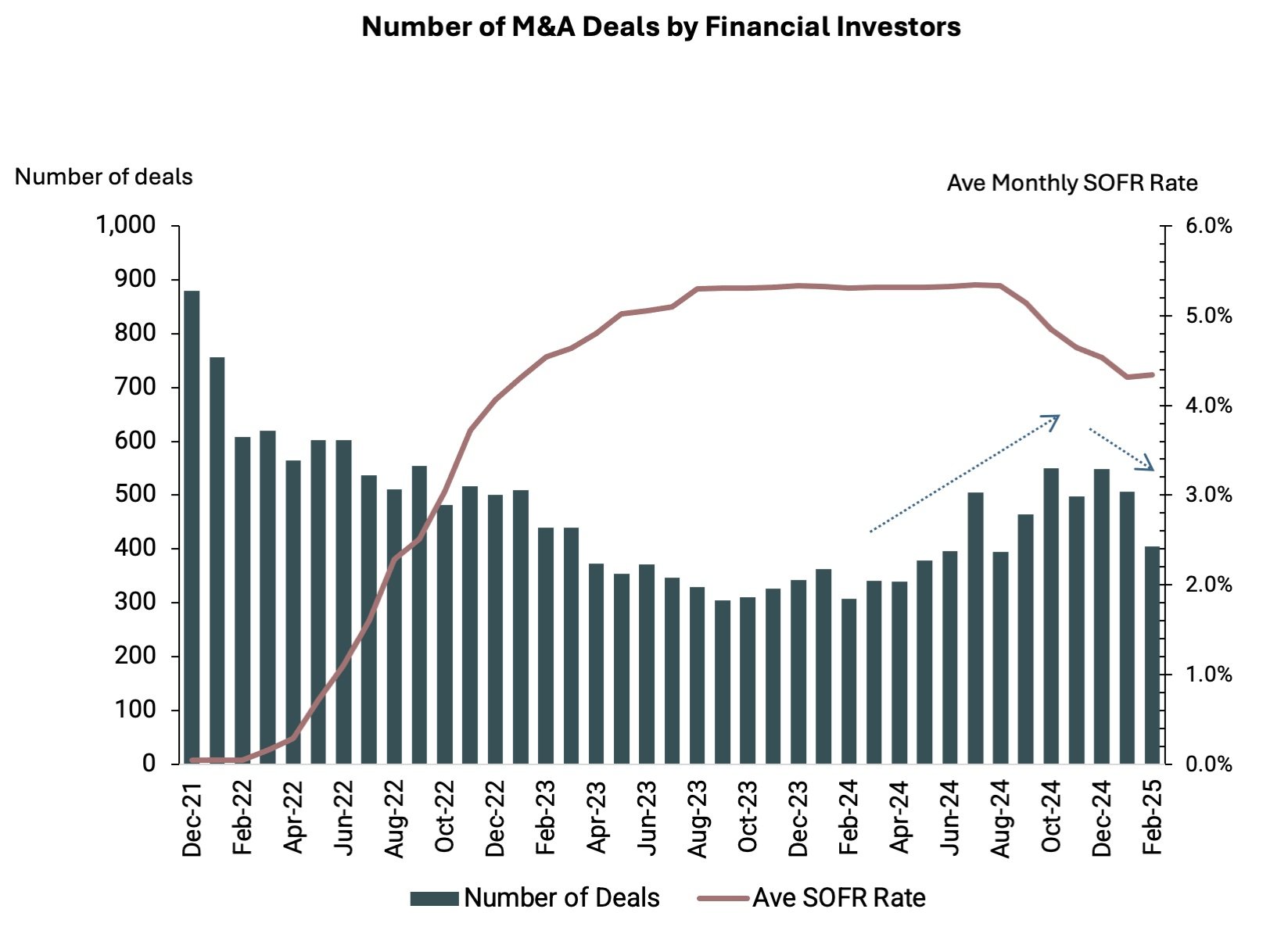

M&A activity showed signs of recovery in late 2024, but market uncertainty in early 2025 has stalled deal momentum. Despite declining borrowing costs and a record $2.6 trillion in private equity dry powder, investor hesitation has grown due to unpredictable trade and economic policies. Companies considering a sale should focus on financial preparedness and operational efficiencies to position themselves for success when dealmaking accelerates.

Preparing for the M&A Process: Laying the Foundation to Sell Your Business

Selling your business is a complex process, and you must be prepared. We cover internal business reviews, key performance metrics, and adjusted EBITDA.

Top 5 Reasons You Should Hire a Generalist Investment Banker

Hiring a generalist investment banker instead of an industry specialist investment banker might be the best decision you could make to ensure a successful business sale or capital raise. Generalist investment banking advisory firms bring broad transaction experience, offer creative deal strategies, and have access to a wide network of buyers, investors and partners.

Q3-24: M&A Activity by Financial Investors Remains Down

Acquisition activity by private equity funds influence mergers and acquisitions (M&A) across many industries, but Q3-24 volume was down 64% from the peak. What does this mean for founder-owned and private companies who want to exit in 2025?

Leveraged Buyout (LBO) Primer

What is a Leveraged Buyout (LBO)? What are the ideal financial characteristics of a LBO target company in the eyes of private equity investors and family offices? Leveraged buyouts (LBO) are a type of acquisition where investors finance the purchase of a target company through a combination of debt financing and equity capital.

Keene Advisors helps to explain and illustrate the LBO process.

Mergers & Acquisitions: 5 Steps to Take When Selling Your Business

Want to sell your business? You may need help figuring out where to start. Our team outlines 5 steps to prepare your business for sale:

Get your business in order, measure your KPIs, position your company for maximize valuation, understand the tax implications for the business owners, and select the right M&A advisor to help you sell your business.