Finding the Right Buyer for Your Business: M&A Acquirer Profiles

Choosing the correct buyer is the most critical decision when deciding to sell your business. We detail the types of M&A buyers–strategic vs financial - and how business owners can best navigate the sale process.

5 Steps for CEOs and CFOs to Mitigate the Impact of Tariffs and Economic Uncertainty

During periods of economic volatility, business leaders must proactively identify and manage risks that can threaten profitability, liquidity, and long-term survival. Here are 5 proven steps to identify and evaluate business risks, assess their impact and likelihood, and develop actionable strategies to ensure financial and operational resilience.

13-Week Cash Flow Model: An Essential Tool to Navigate Economic Uncertainty

Tariffs, potential disruptions to supply chains, and the possibility of an economic recession are causing uncertainty in financial markets and Board rooms. To navigate effectively, CEOs and CFOs must ensure effective cash flow management and ample liquidity under a wide range of possible scenarios. One of the most important tools available to these executives is the 13-week cash flow model.

Assembling the Right M&A Deal Team: Key Advisors That Drive Results

The right M&A deal team drives results that help business owners meet their M&A goals. Who should be on your M&A team?

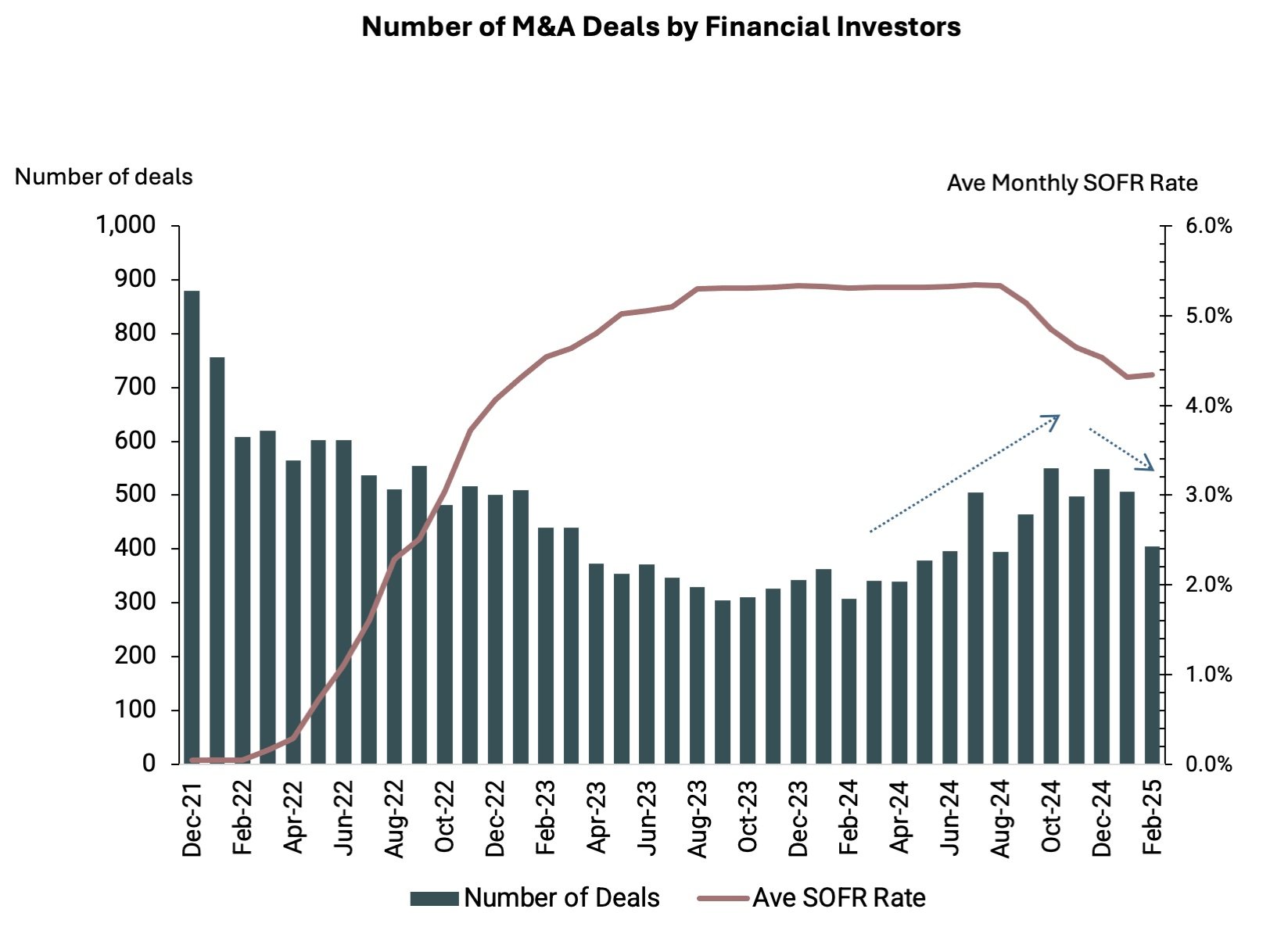

Q1-25: M&A Activity Stalling Amid Market Uncertainty

M&A activity showed signs of recovery in late 2024, but market uncertainty in early 2025 has stalled deal momentum. Despite declining borrowing costs and a record $2.6 trillion in private equity dry powder, investor hesitation has grown due to unpredictable trade and economic policies. Companies considering a sale should focus on financial preparedness and operational efficiencies to position themselves for success when dealmaking accelerates.

Preparing for the M&A Process: Laying the Foundation to Sell Your Business

Selling your business is a complex process, and you must be prepared. We cover internal business reviews, key performance metrics, and adjusted EBITDA.

Understanding the M&A Motivation: Why a Business Founder Might Pursue a Sale

Understanding the motivations behind selling a business should guide a robust M&A strategy. We explain how goals, timing and market consideration impact M&A and why and when business founders should consider selling.

Top 5 Reasons You Should Hire a Generalist Investment Banker

Hiring a generalist investment banker instead of an industry specialist investment banker might be the best decision you could make to ensure a successful business sale or capital raise. Generalist investment banking advisory firms bring broad transaction experience, offer creative deal strategies, and have access to a wide network of buyers, investors and partners.

Maximizing Business Value in a Sale: How EBITDA Addbacks Boost Your Valuation

Learn how EBITDA addbacks can maximize your business’s sale price. Discover key strategies to boost valuation and attract top buyers in M&A transactions.

From Raising Capital to Generating Returns: The Private Equity Fund Lifecycle

Private equity funds serve as a critical source of capital for business owners seeking liquidity or looking to grow, scale, or restructure. Understanding the type of private equity fund, the size of the fund, and where a private equity fund is in its life cycle is important when considering a potential investment or acquisition proposal.