OpenAI Hints at IPO – Will They Become a Public Benefit Corporation?

OpenAI, the company behind the popular generative AI product, ChatGPT, has hinted at launching an IPO and becoming a public company. Currently OpenAI has a unique corporate structure as a hybrid non-profit/for-profit entity but may transition to a for-profit public benefit corporation (PBC). Keene Advisors is also a benefit corporation and we’ll explain what this transition might mean for OpenAI.

Leveraged Buyout (LBO) Primer

What is a Leveraged Buyout (LBO)? What are the ideal financial characteristics of a LBO target company in the eyes of private equity investors and family offices? Leveraged buyouts (LBO) are a type of acquisition where investors finance the purchase of a target company through a combination of debt financing and equity capital.

Keene Advisors helps to explain and illustrate the LBO process.

Mergers & Acquisitions: 5 Steps to Take When Selling Your Business

Want to sell your business? You may need help figuring out where to start. Our team outlines 5 steps to prepare your business for sale:

Get your business in order, measure your KPIs, position your company for maximize valuation, understand the tax implications for the business owners, and select the right M&A advisor to help you sell your business.

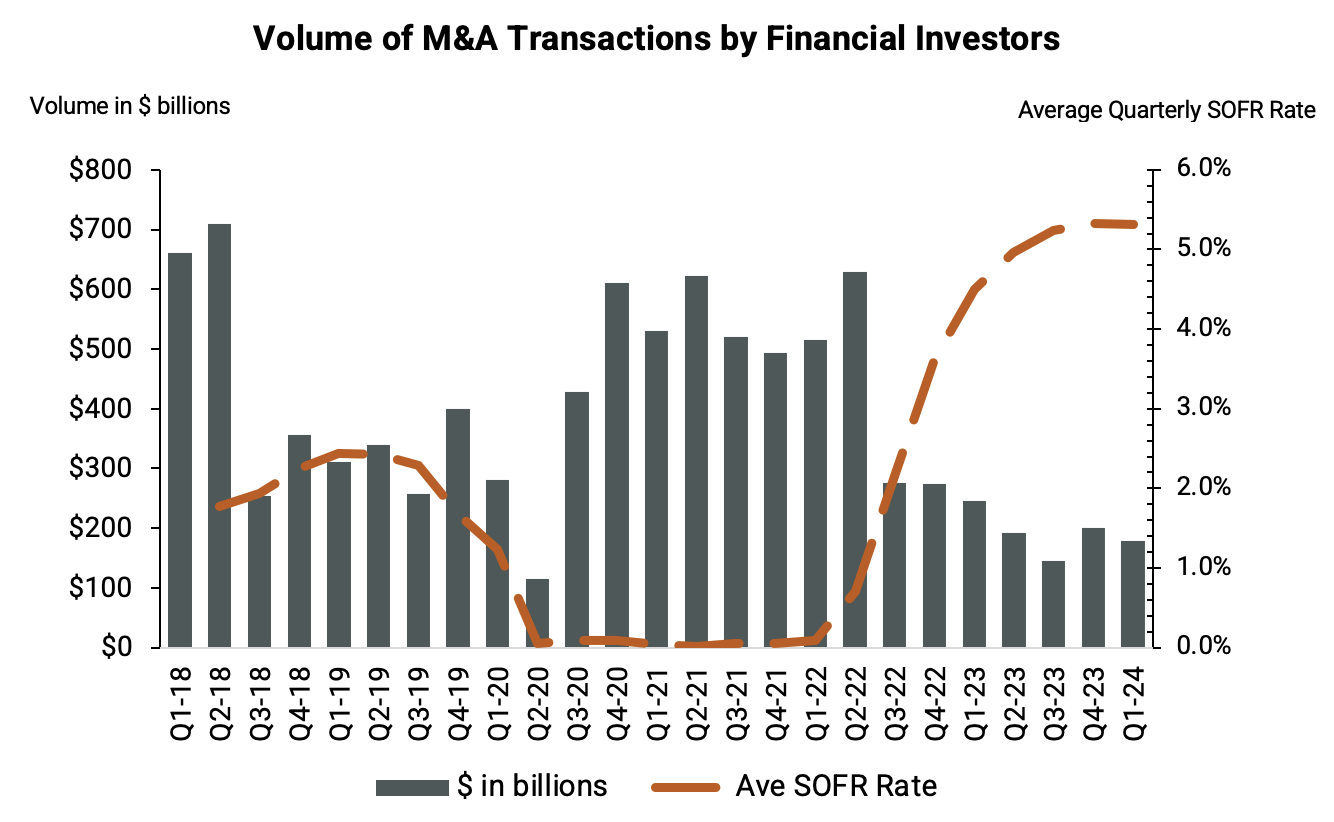

Q1’24: Understanding the Link: How Interest Rates Influence Mergers & Acquisitions by Financial Investors

Financial investors like private equity funds and venture capital firms help shape the market dynamics of mergers and acquisitions (M&A) across many industries. But as interest rates have risen precipitously since 2022, there has been a significant decline in the M&A activity among financial investors. What should companies do who are looking for an exit?

Will Unilever and Ben and Jerry’s Split Impact Other B-Corporations?

Focusing only on the culture clash between Unilever and Ben & Jerry's misses the financial story behind their split. This analysis looks at the history of the ice cream division and what might be next for Ben & Jerry's.

Are there Financial Benefits to Corporate Sustainability Objectives?

Business success largely hinges on giving the customers what they want — and these days, customers want to shop with businesses that prioritize ESG goals and sustainable business practices. But are ESG initiatives profitable? The Keene team weighs the risk and opportunity.

Navigating Capital Raising as a B-Corporation: Opportunities and Challenges

How do B-Corporations navigate the capital-raising process? We highlight the pros and cons companies may encounter along their journey as well as strategic advice for preparation.

Leveraging UN Sustainable Development Goals for Corporate Sustainability Planning

The United Nations Sustainable Development Goals (SDGs) offer a comprehensive roadmap for addressing global ESG challenges. Learn how businesses use the SDGs as a strategic framework for developing robust sustainability plans that drive innovation, enhance brand reputation, and open new markets.

The Rise of Benefit and Certified B-Corporations

The business world has seen a significant shift towards sustainability and social responsibility, with Benefit Corporations and Certified B-Corporations leading the charge. But what are the differences between Benefit Corporations and Certified B-Corps, and why have they grown in popularity?

Overview of Vital Farms’ Initial Public Offering

Overview of Vital Farms’ IPO: how a B Corp offering pasture raised products went from startup to the public markets. A look at private equity deal making amid COVID-19.