5 Steps for CEOs and CFOs to Mitigate the Impact of Tariffs and Economic Uncertainty

During periods of economic volatility, business leaders must proactively identify and manage risks that can threaten profitability, liquidity, and long-term survival. Here are 5 proven steps to identify and evaluate business risks, assess their impact and likelihood, and develop actionable strategies to ensure financial and operational resilience.

13-Week Cash Flow Model: An Essential Tool to Navigate Economic Uncertainty

Tariffs, potential disruptions to supply chains, and the possibility of an economic recession are causing uncertainty in financial markets and Board rooms. To navigate effectively, CEOs and CFOs must ensure effective cash flow management and ample liquidity under a wide range of possible scenarios. One of the most important tools available to these executives is the 13-week cash flow model.

Q1-25: M&A Activity Stalling Amid Market Uncertainty

M&A activity showed signs of recovery in late 2024, but market uncertainty in early 2025 has stalled deal momentum. Despite declining borrowing costs and a record $2.6 trillion in private equity dry powder, investor hesitation has grown due to unpredictable trade and economic policies. Companies considering a sale should focus on financial preparedness and operational efficiencies to position themselves for success when dealmaking accelerates.

Maximizing Business Value in a Sale: How EBITDA Addbacks Boost Your Valuation

Learn how EBITDA addbacks can maximize your business’s sale price. Discover key strategies to boost valuation and attract top buyers in M&A transactions.

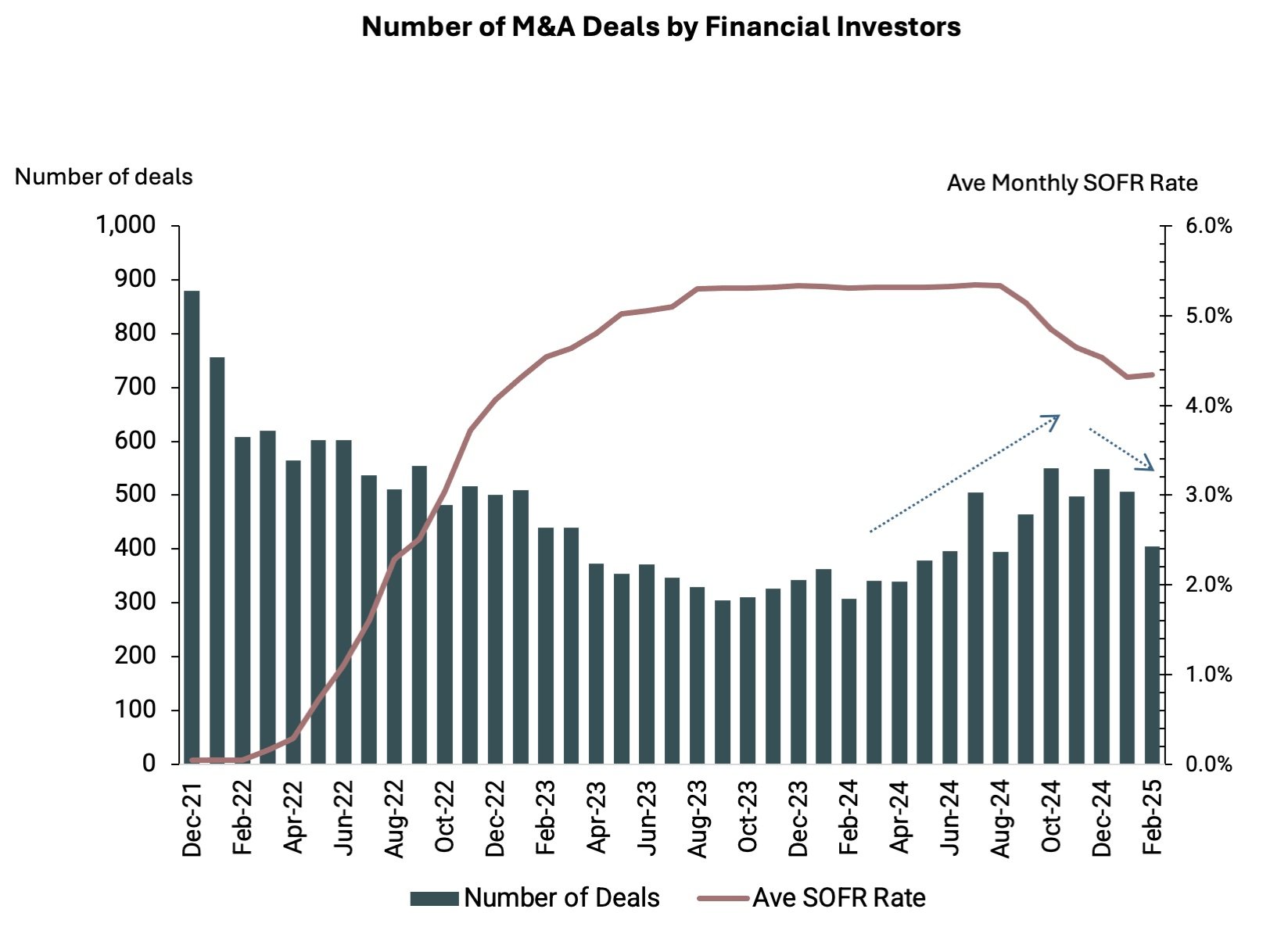

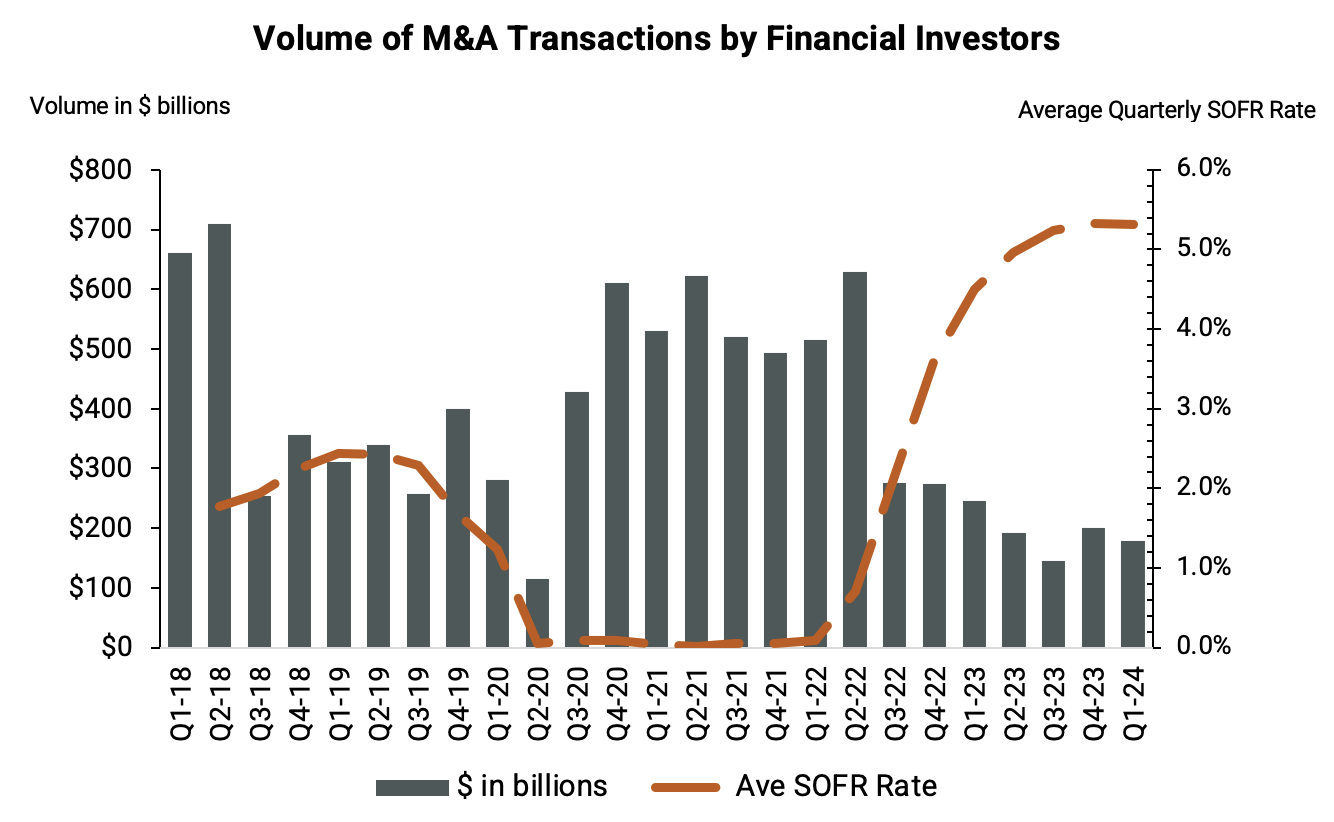

Q3-24: M&A Activity by Financial Investors Remains Down

Acquisition activity by private equity funds influence mergers and acquisitions (M&A) across many industries, but Q3-24 volume was down 64% from the peak. What does this mean for founder-owned and private companies who want to exit in 2025?

Dynamic Budgeting: 10 Steps to Building a Three-Statement Model

An essential tool for every CFO, learn how to build a dynamic budget model and explore the benefits of implementing the best practices of a dynamic budgeting model into your existing process. Complete primer for corporate finance executives that will help increase visibility and prioritize growth, cost savings and capital allocation opportunities.

Mergers & Acquisitions: 5 Steps to Take When Selling Your Business

Want to sell your business? You may need help figuring out where to start. Our team outlines 5 steps to prepare your business for sale:

Get your business in order, measure your KPIs, position your company for maximize valuation, understand the tax implications for the business owners, and select the right M&A advisor to help you sell your business.

Q1’24: Understanding the Link: How Interest Rates Influence Mergers & Acquisitions by Financial Investors

Financial investors like private equity funds and venture capital firms help shape the market dynamics of mergers and acquisitions (M&A) across many industries. But as interest rates have risen precipitously since 2022, there has been a significant decline in the M&A activity among financial investors. What should companies do who are looking for an exit?

Will Unilever and Ben and Jerry’s Split Impact Other B-Corporations?

Focusing only on the culture clash between Unilever and Ben & Jerry's misses the financial story behind their split. This analysis looks at the history of the ice cream division and what might be next for Ben & Jerry's.