Five Steps to Refinancing Your Credit Facility

Learn the five key steps to successfully refinancing your credit facility. From understanding market conditions to selecting the right lenders, ensure your company secures the best terms with expert guidance.

Keene Advisors Insights Series: Corporate Debt Financing

Dig deep with the Keene Advisors' Insights Series on corporate debt financing.

How Much Corporate Debt Is Right for My Company?

What is the optimal level of corporate debt for a company? If you are a CEO, CFO, Executive Board member, or corporate finance professional, you are tasked with asking and answering this question on a regular basis. Striking the right balance is challenging, but the benefits of achieving the optimal corporate debt structure can be significant.

Corporate Debt Refinancing 101: Why and How Companies Refinance Their Debt

Refinancing corporate debt is a strategic process that companies use to optimize their capital structure, reduce interest expense, or extend their debt repayment period. We break down the benefits and considerations of debt refinancing and how to optimize the process for your company.

What is a Corporate Social Investment Strategy? A Guide to CSI

Corporate Social Investment (CSI) refers to the practice of allocating a company's resources—whether in the form of cash, services, products, or employee time—toward social, environmental, and community initiatives that align with its business goals. We dive into the benefits of implementing CSI for your business.

OpenAI Hints at IPO – Will They Become a Public Benefit Corporation?

OpenAI, the company behind the popular generative AI product, ChatGPT, has hinted at launching an IPO and becoming a public company. Currently OpenAI has a unique corporate structure as a hybrid non-profit/for-profit entity but may transition to a for-profit public benefit corporation (PBC). Keene Advisors is also a benefit corporation and we’ll explain what this transition might mean for OpenAI.

Leveraged Buyout (LBO) Primer

What is a Leveraged Buyout (LBO)? What are the ideal financial characteristics of a LBO target company in the eyes of private equity investors and family offices? Leveraged buyouts (LBO) are a type of acquisition where investors finance the purchase of a target company through a combination of debt financing and equity capital.

Keene Advisors helps to explain and illustrate the LBO process.

Mergers & Acquisitions: 5 Steps to Take When Selling Your Business

Want to sell your business? You may need help figuring out where to start. Our team outlines 5 steps to prepare your business for sale:

Get your business in order, measure your KPIs, position your company for maximize valuation, understand the tax implications for the business owners, and select the right M&A advisor to help you sell your business.

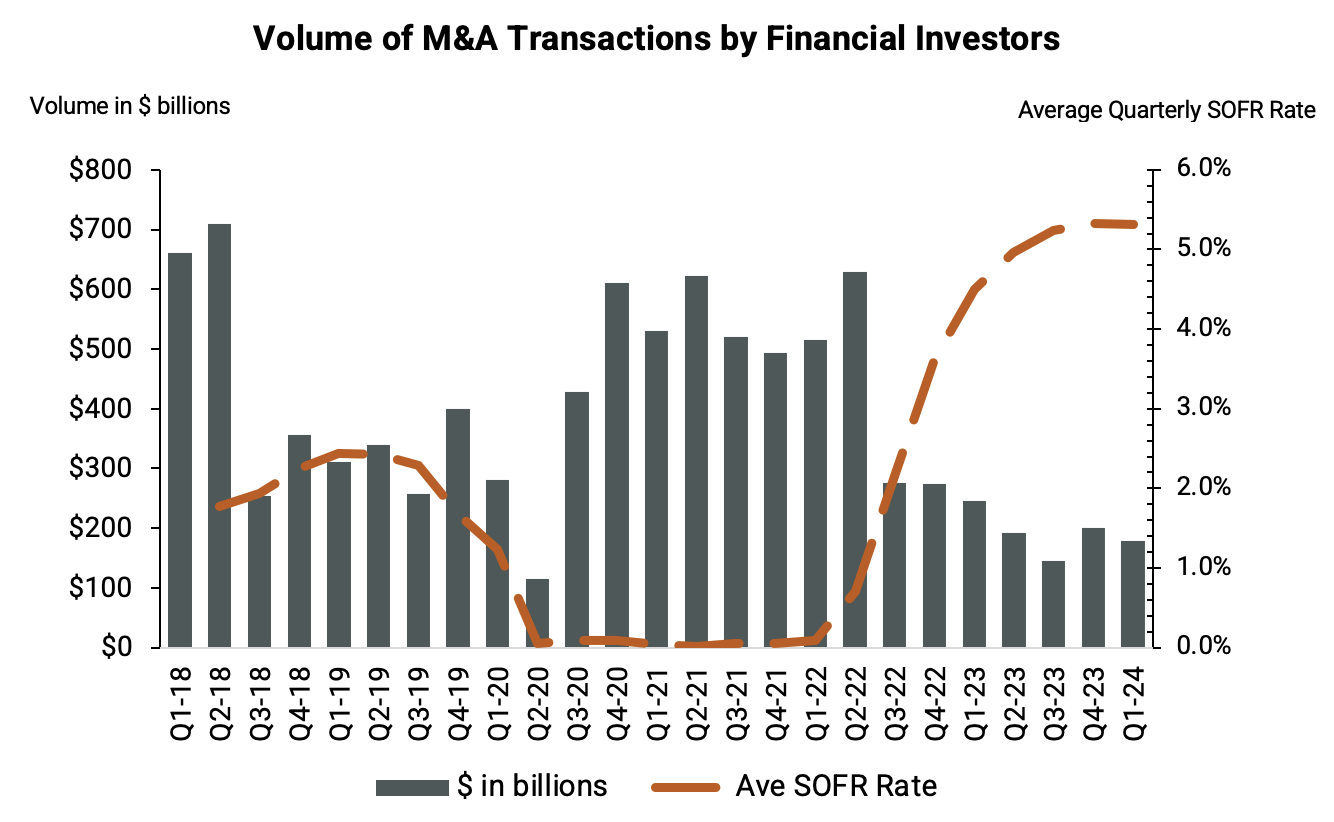

Q1’24: Understanding the Link: How Interest Rates Influence Mergers & Acquisitions by Financial Investors

Financial investors like private equity funds and venture capital firms help shape the market dynamics of mergers and acquisitions (M&A) across many industries. But as interest rates have risen precipitously since 2022, there has been a significant decline in the M&A activity among financial investors. What should companies do who are looking for an exit?

Will Unilever and Ben and Jerry’s Split Impact Other B-Corporations? A Deeper Look at the Financial Performance

Focusing only on the culture clash between Unilever and Ben & Jerry's misses the financial story behind their split. This analysis looks at the history of the ice cream division and what might be next for Ben & Jerry's.