The First 100 Days as a CFO

A CFO's Roadmap to Strategic Impact

The first 100 days in the CFO seat represent a decisive inflection point — the period where credibility is either firmly established or quietly undermined. Master your first 100 days as CFO to build credibility, establish control, and create long-term value.

Tightening Credit Spreads Create Favorable Refinancing Conditions

The credit spread environment remains favorable for refinancing existing credit facilities and originating new corporate credit. Companies with existing credit facilities maturing in the next 12-24 months should consider refinancing in the current credit spread environment, as doing so may generate substantial savings in long-term borrowing costs.

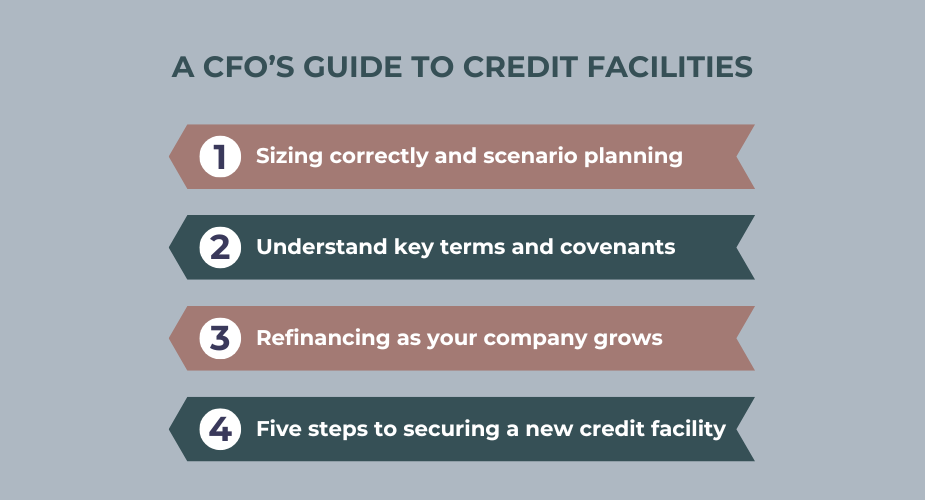

Credit Facility Playbook: A CFO's Guide

For CFOs, understanding the intricacies of credit facilities is essential for optimizing capital structure, ensuring liquidity, and managing cash flow efficiently. Download our in-depth playbook that considers best practices and guidance on how to negotiate the most competitive terms.

Terms and Loan Covenants in a Credit Facility Lending Agreement

The terms and loan covenants associated with a credit facility are critically important for the CEO, CFO and other key stakeholders to understand. These terms are heavily negotiated during the drafting of the credit agreement which can be aided by an experienced financial advisor.

Determining the Right Size for Your Company’s Revolving Credit Facility: A Guide to Liquidity Management

A revolving credit facility helps businesses meet short-term needs and fuel growth. Learn how to size it properly to balance liquidity without overpaying for unused credit.

Five Steps to Refinancing Your Credit Facility

Learn the five key steps to successfully refinancing your credit facility. From understanding market conditions to selecting the right lenders, ensure your company secures the best terms with expert guidance.

How Much Corporate Debt Is Right for My Company?

What is the optimal level of corporate debt for a company? If you are a CEO, CFO, Executive Board member, or corporate finance professional, you are tasked with asking and answering this question on a regular basis. Striking the right balance is challenging, but the benefits of achieving the optimal corporate debt structure can be significant.

Corporate Debt Refinancing 101: Why and How Companies Refinance Their Debt

Refinancing corporate debt is a strategic process that companies use to optimize their capital structure, reduce interest expense, or extend their debt repayment period. We break down the benefits and considerations of debt refinancing and how to optimize the process for your company.