Preparing for the M&A Process: Laying the Foundation to Sell Your Business

Selling your business is a complex process, and you must be prepared. We cover internal business reviews, key performance metrics, and adjusted EBITDA.

Maximizing Business Value in a Sale: How EBITDA Addbacks Boost Your Valuation

Learn how EBITDA addbacks can maximize your business’s sale price. Discover key strategies to boost valuation and attract top buyers in M&A transactions.

Helping Your Acquisition Growth Strategy Deliver Long-Term Value

Organic growth or growth by acquisition? This is a strategic and tactical decision that CEOs, CFOs, and executive teams must constantly weigh. If you do choose to pursue M&A as part of a long-term growth strategy, building your M&A playbook is the key to success.

Mergers & Acquisitions: 5 Steps to Take When Selling Your Business

Want to sell your business? You may need help figuring out where to start. Our team outlines 5 steps to prepare your business for sale:

Get your business in order, measure your KPIs, position your company for maximize valuation, understand the tax implications for the business owners, and select the right M&A advisor to help you sell your business.

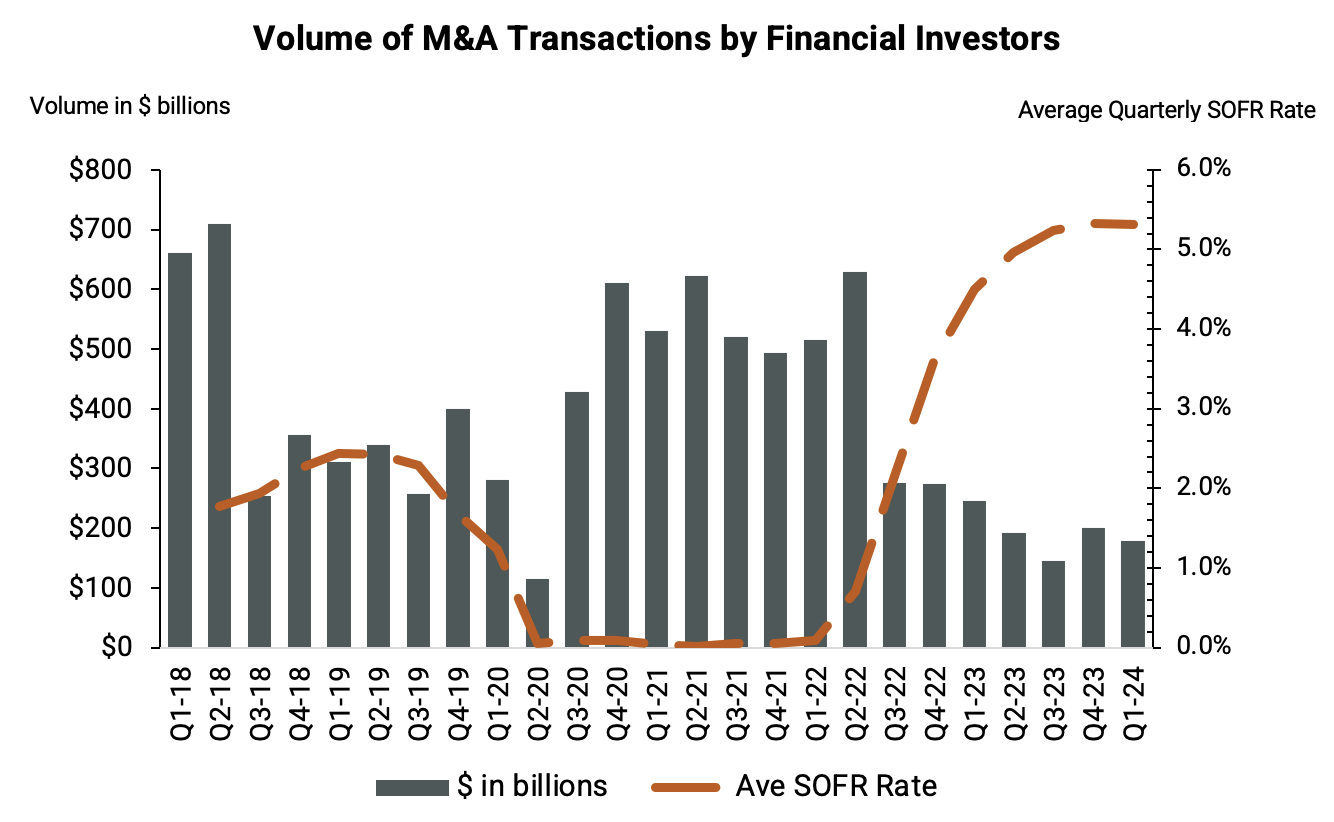

Q1’24: Understanding the Link: How Interest Rates Influence Mergers & Acquisitions by Financial Investors

Financial investors like private equity funds and venture capital firms help shape the market dynamics of mergers and acquisitions (M&A) across many industries. But as interest rates have risen precipitously since 2022, there has been a significant decline in the M&A activity among financial investors. What should companies do who are looking for an exit?

KKR’s Strategic Deal with Coty: Case Study

Overview of private equity firm KKR’s investment in global beauty company Coty. A look at private equity deal making amid COVID-19.

Capture Value with a Winning M&A Pipeline

An effective M&A pipeline is an important component of many companies' growth strategy. Over the past few years of advising companies and private equity firms, we have compiled a list of best practices and useful, customizable resources.

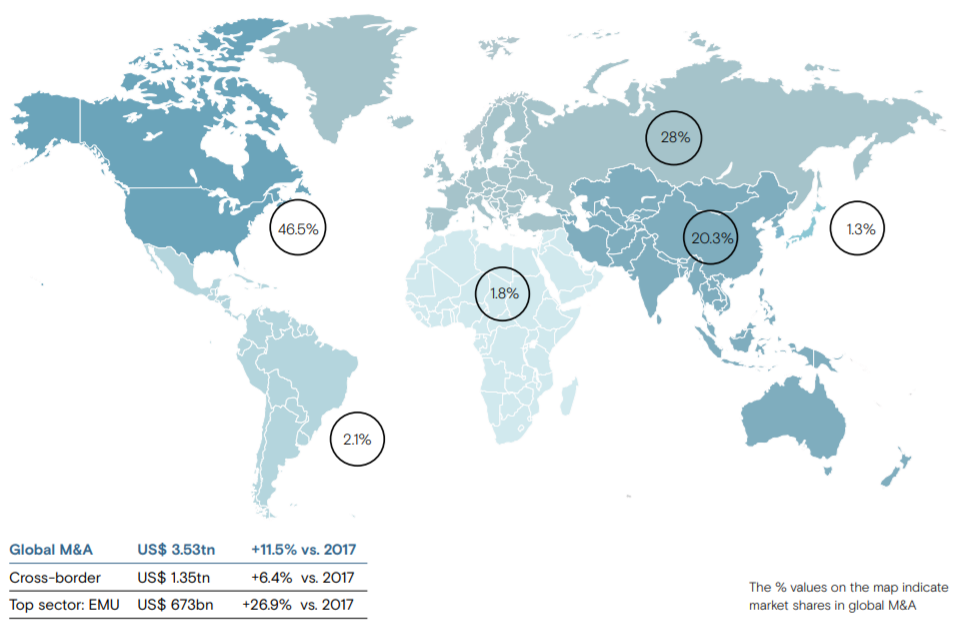

Mergers and Acquisitions, Capital Markets: 2018 in Review

Major Merger and Acquisition and Capital Markets Trends in 2018

Charts and reports providing a snapshot of the most relevant trends in M&A and capital markets in 2018, including IPO activity, leveraged loan issuance and shareholder activism.

Mergers and Acquisitions, Capital Markets: 2017 in Review

Major Merger and Acquisition and Capital Markets Trends in 2017

Charts and reports providing a snapshot of the most relevant trends in M&A and capital markets in 2017, including new record highs in venture capital investments, private equity fundraising and corporate bond issuance.

Mergers and Acquisitions: 2016 in Review

Major Merger and Acquisition Trends in 2016

Charts, reports, videos and infographics providing a snapshot of the most relevant trends in M&A in 2016, including the rise in divestitures, inbound activity in the US and the importance of the middle-market.