What is a Leveraged Buyout and How Does Debt Financing Help an Acquisition?

Is a Leveraged Buyout (LBO) a good strategy for business growth? Leveraged buyouts rely on debt and can enhance equity returns for investors and provide companies with additional access to capital for value creation. But they are not without risk. Disciplined execution is key to success.

Leveraged Buyout (LBO) Primer

What is a Leveraged Buyout (LBO)? What are the ideal financial characteristics of a LBO target company in the eyes of private equity investors and family offices? Leveraged buyouts (LBO) are a type of acquisition where investors finance the purchase of a target company through a combination of debt financing and equity capital.

Keene Advisors helps to explain and illustrate the LBO process.

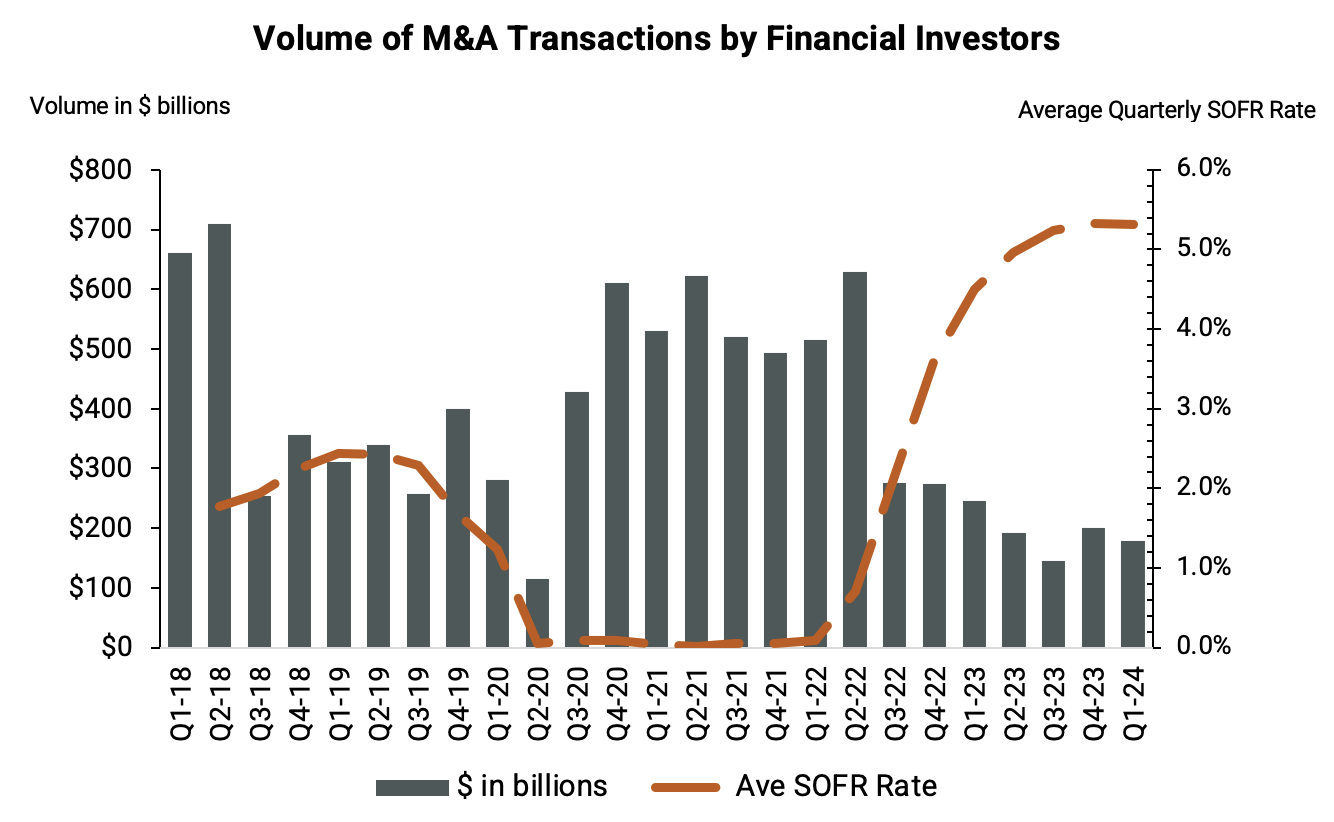

Q1’24: Understanding the Link: How Interest Rates Influence Mergers & Acquisitions by Financial Investors

Financial investors like private equity funds and venture capital firms help shape the market dynamics of mergers and acquisitions (M&A) across many industries. But as interest rates have risen precipitously since 2022, there has been a significant decline in the M&A activity among financial investors. What should companies do who are looking for an exit?