Mergers & acquisitions and the capital markets: 2018 in review

M&A remains strong. Global M&A value was $3.53 trillion; 11.5% above 2017. Two key factors fueled this growth: an increase in megadeals (those valued $5 billion and above) and strong activity in North America. Globally, companies announced 103 deals with a transaction value of at least $5 billion in 2018, which is the second-highest total since 2007. The U.S. accounted for 55 of these megadeals, and generally experienced a 15.4% increase in M&A values compared to 2017.

IPO activity surges in the U.S.; falters globally. In the first three quarters of 2018, U.S. IPO deal proceeds increased 41% to $50.1 billion and deal numbers rose by 27% to 195 IPOs. In the U.S., 2018 brought the best second and third quarters in IPO activity since 2014. Globally, IPO activity faltered somewhat as geopolitical uncertainties and trade issues dampened the market. The number of IPOs in the first three quarters of 2018 fell to 1,000 globally. This is an 18% decrease from the same period in 2017, which saw the highest nine-month activity since YTD 2007.

Private equity momentum endures. Globally, the private equity industry recorded another strong year in dealflow in 2018. With more than 5,000 deals and a corresponding value of more than half a trillion dollars, buyout activity continued in the ascending trend observed since 2009. Buyout-backed exits were slightly down, consistent with a trend that began in 2015. In the U.S., the elevated amount of dry powder to be deployed, along with the growing average deal value, pushed median EV/EBITDA (enterprise value to earnings before interest, taxes and depreciation) multiples up to 12.3x from 12.1x in 2017.

Leveraged loan issuance remains elevated. Globally, new issuance of leveraged loans hit a record $788 billion in 2017, surpassing the pre-crisis high of $762 billion in 2007. The United States was by far the largest market last year, accounting for $564 billion of new loans. As of Q3 2018, issuance had reached an annual rate of $745 billion. More than half of the money borrowed in 2018 went to fund mergers and acquisitions and leveraged buyouts (LBOs), pay dividends, and buy back shares from investors.

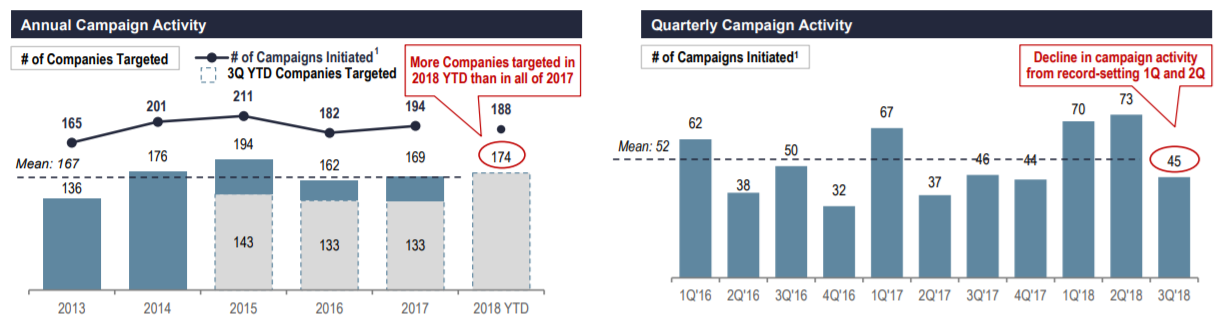

Shareholder activism increased meaningfully. Activists targeted 174 companies in the first three quarters of 2018, surpassing 169 companies targeted in all of 2017. Board change and M&A were the most common objectives of activist campaigns. The number of activists and new activists in the first three quarters of 2018 were at record highs, and the number of board seats won was on pace to break the record set in 2016.

Source: Mergermarket

Source: FactSet

Note: data for U.S. IPOs

Source: Activist Insight. FactSet and public filings as of 9/28/18. Via Lazard.